How to Win at Equity Crowdfunding – Six essentials lessons for your next fundrais

May 2, 2020

My latest equity crowdfunding campaign raised 500% above its goal, was featured on the major equity crowdfunding podcasts, was endorsed by a leading think-tank and won to the semi finals of the silicon valley reality TV show, Meet the Drapers. Could we have done better…raised more money? Yes, of course! Here are some the things I learned as a founder in the trenches of equity crowdfunding.

What is Equity Crowdfunding?

At its most simplest, crowdfunding is raising capital from the crowd online. Equity crowdfunding is a financial mechanism that enables a broad group of investors to fund a startup company or small business in return for equity. it’s raising capital from the crowd through the sale of securities (shares, convertible note, debt, revenue share, and more) in a private company (that is not listed on stock exchanges).

There are a variety of options for startups to raise capital. The process of fundraising is hard and does not happen overnight. Entrepreneurs may turn to outside sources of capital to provide the company with enough runway to become profitable. Most early-stage (pre-revenue) startup founders may turn to friends and family, angel investors or VCs.

Equity crowdfunding was enabled in the US when President Obama signed the JOBS Act. However, the two regulations of equity crowdfunding weren’t implemented until June 2015 and May 2016. So equity crowdfunding is still relatively new.

The Difference Between Kickstarter Crowdfunding and Equity Crowdfunding

As an entrepreneur you may find yourself trying to decide your fundraising options. Hopefully, you’re evaluating and planning with sufficient runway. The key difference you should have in mind before turning to the crowd is being clear on what you intend to sell. Kickstarter and Indiegogo campaigns are intended to raise capital through the pre-sale of a product. The pre-sale campaign is done with a discount and various tier and perks in order to attract new customers and fans. The contract between the company and the customer or “investor” of a Kickstarter campaign concludes as soon as the customer receives the product or perk.

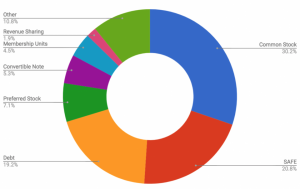

The intent of an equity crowdfunding campaign is the sale of securities, whether in the form of equity in the company, debt, revenue share, convertible note, and more as shown in the chart below. Investors in equity crowdfunding don’t participate just to buy a product at a discount a year before its release; they stand to make a profit if they make a good investment and the company they invested in grows.

The most important thing I learned is that both require a lot of preparation, work and capital investment. We’ll focus on what any entrepreneur should consider to plan and execute a successful equity crowdfunding campaign.

1. Know the basics and what your committing to in the short and medium/long-term.

There exist a variety of equity crowdfunding platforms the promise access to investors communities, exposure, help building your campaign and will handle the regulatory and compliance ‘back-end’ of your fundraise. These platforms work on a commission fee structure, either from a percentage of your total fundraise and a percentage of equity in your company. Do your homework, investigate which platforms may be the best fit for your business. Reach out to and try to speak with entrepreneurs who are currently fundraising (or have fundraised) on the platforms. You should also interview the platform, get to know who the principal are and who you’ll be working with. Remember, you’re committing to work with them for at least 6-9 months (including pre-campaign and campaign), and you need to find the right fit. Find out who will go the extra mile: offer access to media and other opportunities that can enhance your campaign.

You should also understand and plan for your campaign timeframe, which can be anywhere between 5-12 months. This includes pre-campaign, live campaign time and close. Make sure that this timeframe is aligned with your business objectives and fits within your current fundraising activities, and your runway. Be aware that you will not be able to take in outside investments during the time that your campaign is active because of the securities regulation.

2. Prepare the back of house: Due Diligence, Audits, Reviews and Regulations

Equity crowdfunding is a regulated process because you are making a public offering and sale of securities in your company. You’ll need to prepare for a complete due diligence before launching your campaign. The best equity crowdfunding platforms will walk you through the DD process and help you get organized. You should know that this is an extensive process covering everything about your business, the founders and current stakeholders. The first thing you should get ready for is the initial review by the equity crowdfunding platform. Treat this initial review like pitching to an investor or VC. You should have a pitch deck and be ready to answer questions. Other thing you should have ready, and by no means it’s a complete list, are:

- Incorporation documents, EIN, RSAs, employee contracts, etc.

- Cap table

- IP, patents, etc.

- Accounting books since the start of operations reconciled and up to date

- Three-year financial projection

- Proposed plan of use of funds

And that’s just to get you started. I recommend creating a Data Room where these files and documents can readily be shared. You’re going to be sharing them more than once.

Part of the pre-campaign work involves filing important securities regulation and compliance paperwork, which involves:

- Background check or ‘bad actor’ check on anyone who is a majority owner (whether US or non US resident) of the business.

- Financial GAAP accounting review by a third party. Yup, here is where it get interesting. All your financial have to under go a third party review.

- Legal review of the company by an outside counsel.

- Form C filing.

Most platforms will recommend or have their third party financial and legal auditors. You should definitely budget for this, anywhere between $5-10K for these audits. Most platforms will defer these fees and will access them at closing or during a rolling close of your campaign. Remember that any changes during the live campaign like doing a rolling close or extending your offering require a review, so budget accordingly.

3. Content is king

This goes without saying, you’re going to need content: a written campaign pitch, images, and a video. Writing a campaign pitch for crowdfunding is going to require special attention as you’re making an appeal to a broad audience. Preparing the content for your campaign is a process that will take a couple of months, and requires a lot of review. So don’t leave it to the last minute. We reviewed a lot of the successful campaigns on the platform to get a sense of the style and content provided. I also recommend working it up on a google doc so you can have collaboration within your team and allow for reviewers to provide feedback. You may want to engage with a copy-writer and editor. Your branding should also be well defined and if possible have a designer work with you on the creatives for the campaign.

You video pitch is an important piece of you pitch. Please take into account that a quality video takes a coupe of months to plan and produce. Video production can cost you anywhere from $3,000 to upwards of $10K. Again, we reviewed successful campaign videos for duration, style and pitch.

Some platforms may require you to offer campaign perks. We designed our campaign perks and we leveraged our campaign manager for advice and feedback.

You also need to prepare additional content for social media, newsletters, email marketing etc that will run throughout the life of your campaign. It’s important that you and your team familiarize yourselves with the communication guidelines and adhere to the regulatory guidelines before and during your campaign.

4. Build an army: pre-sell commitments and audience

Every platform will promise you access to thousands of investors within their community. By no means you should think of any crowdfunding activity as something that will happen organically or ‘magically’. Here is where you need to put in a lot of work as well.

Acceleration to your goal is paramount to success. Like Kickstarter, most platforms use algorithms to rank, feature and put forward the campaigns with the best tractions and those likely to blow up the goals. So your exposure and opportunity to reach investors on the platform may be beholden to some algorithm. So get those pre-commitments before you launch, and reach your public fundraising goals in the shortest amount of time possible. Each platform may vary, but ours suggested to reach our public goal within 2-3 weeks.

Build your mailing list before you launch. You may have various segments within your overall list, i.e current investors and advisors, partners and customers as well as your followers and audience. The important thing to remember is that you need to take into account what you can and cannot do in your written communication because of the regulatory compliance that you must follow. Knowing the do’s and don’t before and during your campaign is live well inform your marketing strategy. The compliance guidelines are strict. so I recommend reviewing your platform guidelines.

5. Promote, advertise, and activate your ambassadors

It’s your job to get potential investors to your campaign. Your fundraising campaign may be running anywhere between 3-6 months and you should rely entirely on the crowdfunding platform. It’s important to have a marketing strategy for the entire period of time. Your activities may include:

- Activation of your customers, current investors, advisors, followers and audience. Email drip campaigns are very helpful. You should design a plan that will take you through the entire time your campaign is live.

- Exposure from your campaign platform or provider. Make sure you know exactly what your platform provides in terms of providing exposure to their entire community. In our case, we had to hit our campaign goal before getting featured on the community-wide email. The community-wide email provided a huge bump ~6X in our fundraise. You should know what it takes to get featured, get a better placement on the online site, etc.

- Paid Promos. You campaign platform may offer paid promos. You should budget for this and invest the time and effort to attain a good ROI.

- Media exposure. Getting feature in the press and media is always great but you should never rely on it as a predictive tool to sell. You should create a media plan and especially target those media most related to equity crowdfunding, investing etc. We applied early on to compete on the Silicon Valley reality TV show Meet The Drapers. You can learn more about what it takes to pitch your startup on TV by checking out my article on this topic.

- Targeted Adverts. I highly recommend having a budget for target advertising and content marketing on social media and google Adwords. We used Facebook targeted ads with a very good ROI. Our campaign provider first provided us paid adverts up to a certain cash amount. We leverage our partnership to experiment and optimize the targeting parameters for audience and creatives. This gave us a ‘leg up’ by the time we started running our own adverts. You should definitely speak with your campaign provider about what marketing services they provide.

6. Engage, update and activate your campaign investors and followers

Here is the part where most founders may find themselves completely overwhelmed, and communication is king! Your online campaign page will have a public area for questions and discussion. It will also include a public area for updates about your company, reviews and in the backend, a way to message your investors. You and your team need to be on top of all of these for the entire life of your campaign.

- Make sure your platform has a good email backend system for communicating with your investors.

- Create a frequently asked questions, FAQ section within your campaign. A well prepared FAQ section can readily be used to manage posts and questions on your campaign forum.

- Think just-in-time to answering questions and replying to posts on your page. Your responsiveness and public perception is critical. You should monitor your campaign page activity regularly throughout weekdays and weekends. You platform may provide email alerts when comments are posted on your page. I try to answer post as soon as possible and within 4 hours.

- Monitor your list of incoming investors and use your platform backend email system to communicate with them. I use our system to reach out to investors who all of sudden change their mind, i.e. reduce their investment amount or back out completely. It’s up to you to leverage this system. You may even run micro-campaigns to activate investors to increase their investment amount.

- Always update. The best campaigns are those that provide the most frequent updates and activate their community of followers and investors. You should at least provide an update every two week. Create a plan with your team and design a consistent communication strategy.

Be sure to sign up to my newsletter, follow me on Facebook and Linked In to get the latest news and helpful articles straight from the trenches.